Fidelity International Online Assessment: Complete Guide 2025

- The Fidelity International Online Assessment consists of 3 parts

- Situational Judgment Questions, Personality/Work Style Questions and Numerical Reasoning Questions

- In total there are about 25 questions and the whole assessment should take 45 minutes

- The Assessment Provider is Cappfinity at the end of ther asseesment you should get a feedback report

- Some of the questions require you to analyse data and make judgement based on the provided questions

- For the personality behaviour you are required to make judgments based on personal character and experiences.

Explore Fidelity online assessment

Fidelity Situational Judgment Questions

- Present workplace scenarios where you need to rank potential responses from most to least likely to do

- Use a 1-5 ranking system, with 1 being what you would most likely do and 5 being least likely

- Focus on how you would handle specific professional situations and challenges

- Examples include handling stakeholder meetings, working on projects, and managing disagreements with colleagues

Fidelity Personality/Work Style Questions

- Use slider-based questions to indicate your preferences between two options

- Cover topics like:

- Work environment preferences (stable vs. changing)

- Approach to challenges and setbacks

- Goal-setting and achievement style

- Working under pressure

- Balance between work and other commitments

- Adaptation to change

- Problem-solving approaches

- Key Assessment AreasDecision-making capabilitiesTeamwork and collaborationInitiative and proactivityResponse to change and challengesProject management approachResearch and analytical skillsProfessional development mindsetWork-life balance perspectives

- Assessment FormatNot time-limited but expected to take around 45 minutesRecommended to complete in one sittingShould be done in a quiet place without interruptionsCan use zoom in/out functions for better viewingBest experienced using Chrome browserContains fictitious scenarios and dataRequires honest answers based on personal preferences and working style

- Technical RequirementsStable internet connection neededRecommended to use desktop computer or laptopChrome browser preferred (Firefox or Opera as alternatives)Save & Close functionality available

Has tutorial and help options available

Fidelity international online assessment free

Fidelity international online assessment questions

Fidelity international online assessment answers

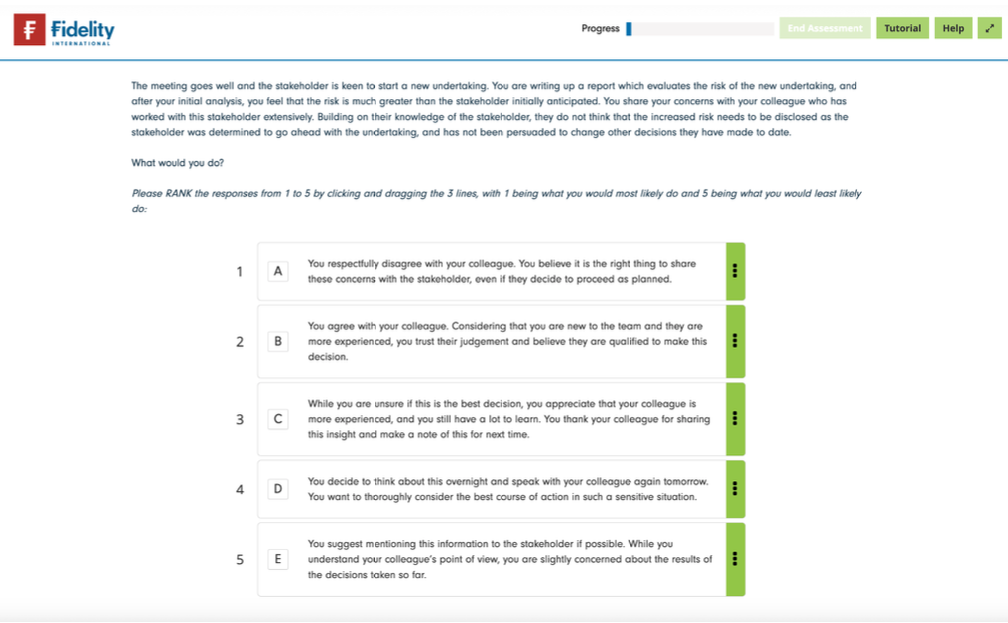

Scenario: You've identified higher risks in a stakeholder's new undertaking than initially anticipated. Your colleague, who has extensive experience with this stakeholder, disagrees about disclosing these risks. The stakeholder is committed to proceeding regardless.

Let's rank the responses from most appropriate (1) to least appropriate (5):

- Option D (Rank 1)

- Taking time to think and discuss further shows careful consideration

- Demonstrates professional judgment in handling sensitive situations

- Allows for thorough evaluation without rushing into decisions

- Balances urgency with due diligence

- Option A (Rank 2)

- Shows integrity in standing up for risk disclosure

- Prioritizes professional responsibility

- Respects stakeholder's right to informed decision-making

- Maintains ethical standards

- Option C (Rank 3)

- Acknowledges colleague's experience while maintaining awareness

- Shows learning mindset and appreciation

- Keeps notes for future reference

- Balanced but somewhat passive approach

- Option E (Rank 4)

- Attempts compromise but lacks conviction

- Could lead to unclear communication

- Doesn't fully address the risk concerns

- Too tentative given the serious nature of the risks

- Option B (Rank 5)

- Inappropriately defers to colleague despite valid concerns

- Fails to fulfil professional responsibility

- Experience shouldn't override valid risk assessment

- Could lead to serious consequences if risks materialize

Reasoning: The best approach (D) balances respect for both the stakeholder and colleague while ensuring proper risk management. The worst approach (B) abandons professional responsibility for risk disclosure. Middle options represent varying degrees of assertiveness and compromise.

Understanding the Fidelity Online Assessment

The Fidelity International online assessment is an untimed evaluation designed to assess candidates' capabilities across multiple dimensions. This assessment is a crucial part of Fidelity's recruitment process for both graduate schemes and experienced professional roles.

Key Components of the Assessment

The assessment is divided into three main sections:

1. Showcasing Your Capability

This section focuses on numerical reasoning skills, essential for roles in financial services. You'll encounter:

- Data interpretation from tables and graphs

- Percentage calculations

- Ratio analysis

- Currency conversions

- Basic arithmetic operations

Example Question Type:

You might be presented with a graph showing investment performance data and asked to calculate percentage returns or compare performance across different time periods.

2. Opportunities For You + About Fidelity International

This combined section assesses both personality traits and situational judgment through:

- Workplace scenario analysis

- Team interaction scenarios

- Client relationship situations

- Professional dilemma resolution

- Decision-making processes

Format:

Questions typically present a workplace situation along with a colleague's background information, asking you to evaluate different approaches to resolving conflicts or handling challenges.

3. Getting To Know You More

The personality assessment section includes:

- Scaled-response questions

- Personal preference evaluations

- Work style assessments

- Behavioral tendency analysis

Preparation Tips for Success

Numerical Reasoning Preparation

- Practice financial calculations regularly

- Familiarize yourself with:

- Investment performance metrics

- Percentage changes

- Market analysis calculations

- Data interpretation techniques

Situational Judgment Preparation

- Research Fidelity's core values and culture

- Review common workplace scenarios

- Practice professional decision-making

- Focus on client-centric approaches

Personality Assessment Tips

- Be consistent in your responses

- Answer honestly rather than trying to guess "correct" answers

- Consider Fidelity's values when responding

- Maintain professional perspective

Key Success Factors

Time Management

While the assessment is untimed, it's recommended to:

- Maintain a steady pace

- Complete all sections in one sitting if possible

- Allow sufficient time for careful consideration of responses

- Review answers before submission

Technical Preparation

Ensure you have:

- Stable internet connection

- Quiet environment

- Calculator ready

- Note-taking materials

- Basic financial knowledge refreshed

Common Questions About Fidelity's Online Assessment

Q: How long does the assessment take?

A: While untimed, most candidates complete it in 60-90 minutes.

Q: Can I use a calculator?

A: Yes, calculators are permitted for numerical sections.

Q: Is there negative marking?

A: No, there's no penalty for incorrect answers.

Q: Can I retake the assessment?

A: Typically, candidates must wait 6-12 months before reapplying.

After the Online Assessment

If successful, candidates progress to:

- Telephone interview (30-45 minutes)

- Assessment centre activities including:

- Presentations

- Group exercises

- Case studies

- Face-to-face interviews

Tips for Different Candidate Types

Graduate Candidates

- Focus on demonstrating potential

- Highlight academic achievements

- Show enthusiasm for financial markets

- Emphasize teamwork experiences

Experienced Professionals

- Draw on relevant work experience

- Demonstrate industry knowledge

- Show leadership potential

- Highlight client relationship skills

Conclusion

- The Fidelity International online assessment is a comprehensive evaluation tool designed to identify candidates who align with the company's values and possess the necessary skills for success.

- By understanding the assessment structure and preparing thoroughly, you can maximise your chances of progressing to the next stages of the recruitment process.

- Remember that the assessment is just one part of Fidelity's holistic evaluation process. Focus on showcasing your authentic capabilities while demonstrating alignment with Fidelity's values and culture.